Crazy week for oil – negative front month WTI prices and the near implosion of USO. Lots of retail investors started piling into USO, betting on an oil price recovery. Given the surfeit of “USO Bad” news articles, it’s become fairly clear why a long term bet on USO is a bad idea.

Here’s a brief synopsis:

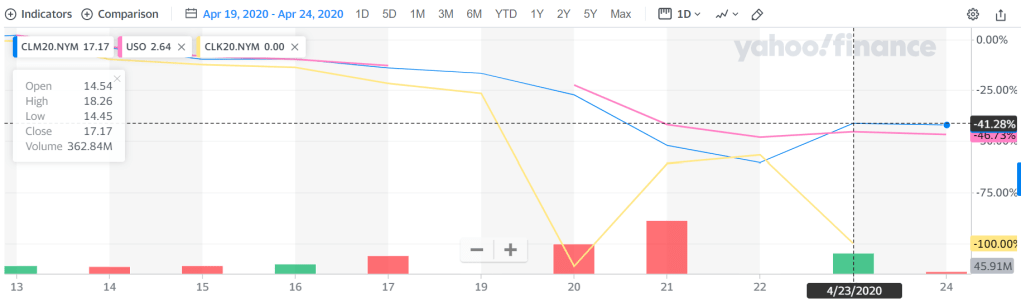

- USO is an ETF that attempts to track rolling front month WTI. This is not the same as the front month WTI prices that folks see on the news. In the past week, USO price movement has been driven by the June/July WTI contracts, which have seen comparatively less price movement than the eye-watering volatility of the front month May WTI contract.

- Given the current super-contago shape of the curve, USO’s monthly roll (selling the devalued front month future contract and buying the more expensive second month futures contract) is going to cause massive bleeding. Luckily, USO wasn’t affected by negative front month prices because it had already rolled into the June/July contracts in early April.

- USO has seen massive retail investor inflow over the past two weeks. This is causing serious problems with both single futures contract capacity limits as well as new share issuance.

- In order to avoid holding more than 25% market share of the front month contract, USO is restructuring to hold multiple further out contract months. The resultant structure will be more stable and look more similar to USL (12 month rolling futures).

- USO has temporarily suspended new share issuance because it has hit a regulatory share issuance cap. The ETF is attempting to both increase the cap as well as engineer a reverse-split. For now, USO is floating on the market, with the ETF authorized participants unable to use redemption/creation mechanics to control USO’s price.

- As of right now, it’s clear that the ETF is broken, but there’s still many unknown unknowns. At best, USO is giving you some partial oil exposure and whole bunch of idiosyncratic gunk mixed in.

You ask – how did I burn myself? Hindsight is 20/20 and this Fri retrospective shows that I’m in the same boat as all the other USO retail investors. On Monday, as May WTI cratered, I wanted to make a dead-cat-bounce bet for Tue. I was aware of the above points 1 & 2. but I figured the entire curve would shift with front month. I put on a 10 USO 200619 C 5, thinking I was getting a good deal ($0.41/option) at the intraday USO low (-10%). Over the next two days, both Jun WTI and USO cratered by -40%, with USO’s mechanical problems coming to light. Thoroughly humbled, I exited Thursday at ($0.10/option) with my calls irrecoverably OTM, PNL = -$310 (-76%). At the time of unwinding, I admit I was tempted to just let the option play out – there was plenty of time left and maybe USO would recover before the next roll in 3 weeks. Luckily, my trading discipline prevailed and I managed to get out of this losing hand.

In retrospect, given the volatility, I should have realized that front month had disconnected from the rest of the curve. I’d become accustomed to USO and front month WTI moving in tandem and figured my short time horizon would keep me safe. As more news rolls in about retail investors getting burnt by USO, I think to my ignominious learning experience – the most predictably dangerous fool is the one unaware of his own ignorance.