At Goldman, I observed that the closer you worked to markets, the more boring your personal trading account. Most folks on the trading floor (myself included) just jammed it into US equity, with some tech and crypto bias. A combination of trading restrictions and the zeitgeist of unbeatable markets leads most people to just passively invest in index funds and only occasionally bet on a YOLO rocket ship. This means that unless your day job is specifically “options trader,” you probably don’t have that much options experience. As a desk quant, I knew the ins and outs of risk and pricing these options despite never having traded one myself.

After five years, I’ve finally set up my personal account to trade options. For the duration of my funemployment, I have temporary freedom from draconian trading restrictions. While I firmly believe that I have no business day trading options in my personal account, I do think there’s a convincing case to occasionally use them for leveraged, high confidence coin flips. My goal is to familiarize myself with the mechanics and risk tools of trading options in my personal account. Consider this an expensive pay-to-play education – fingers I have and unburnt they are.

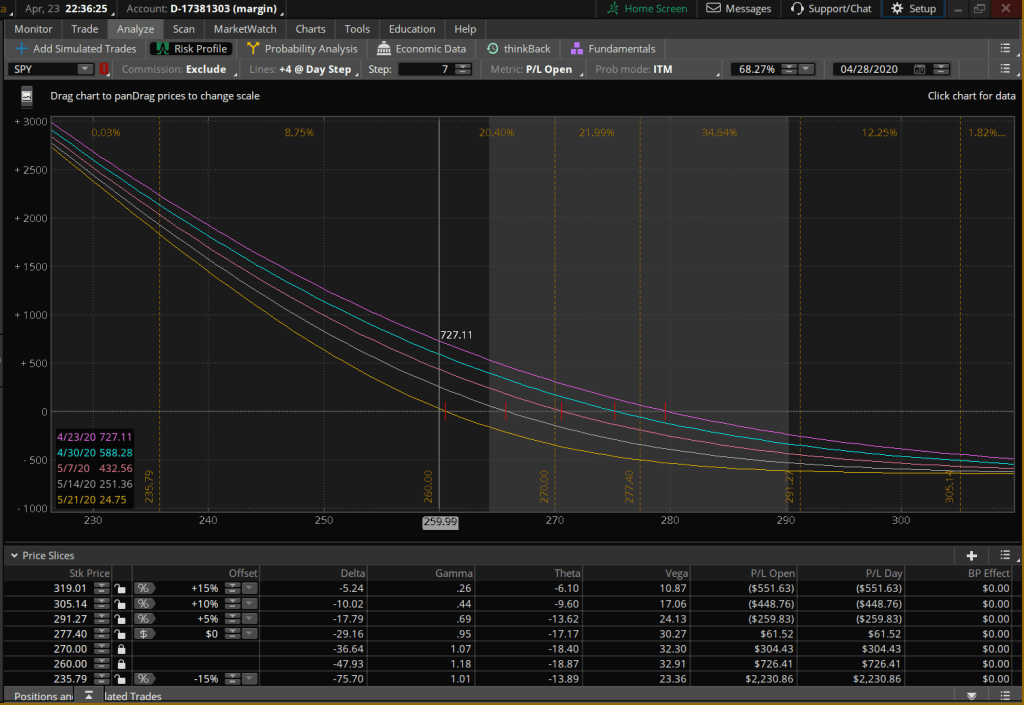

A two week process has cleared my Fidelity personal account to trade options. I’m using TD Ameritrade’s ThinkorSwim paper-trading platform to replicate the trades and manage the risk.

My trade theses are: 1) short SPY until COVID lockdowns end and 2) long oil after the supply/demand fundamentals equilibrate. So far, I’ve put on a SPY 200515 P 260 and a USO 200619 C 5.

I put on the SPY put two weeks ago, anticipating that the true extent of earnings season underperformance hadn’t been priced in yet. I choose this particular contract because 1) the tenor matched the length of earnings season and 2) the option premium ($8.71) was reasonably in budget for me – I didn’t want to blow more than $1k in premiums on a single position. Since then, markets have had a slightly positive wobble and my PNL is -$424 (-49%), half from two weeks of theta decay and half from delta movement. Today, I rolled forward the position into SPY 200529 P 260, extending the trade by two weeks and avoiding the accelerated theta decay. I was surprised by the limited liquidity for this weekly traded options tenor – bid/ask on the screen was five cents wide.

It’s been quite frustrating waking up every day and watching markets inexorably tick upwards. I certainly now have a better feel for the old adage – “markets will stay irrational longer than you can stay solvent.” I’m still fairly confident in my short SPY view – 1) optimism from stimulus policy can’t last forever, 2) earnings season underperformance isn’t adequately priced in and will outweigh any COVID treatment bumps, 3) real economy recession risk despite the loosening economic lockdown.

More on my disastrous USO trade tomorrow.

Pingback: Day 20: SPY Puts – Erick's Blog